HR compliance isn’t just about understanding the changes that are happening in the market. It requires continuous efforts to understand and implement the regulations within the business framework. This comes as a tough challenge for so many organisations irrespective of their size. Not complying with those rules isn’t an option, as it can lead to fines, legal issues and other substantial damages that businesses cannot afford.

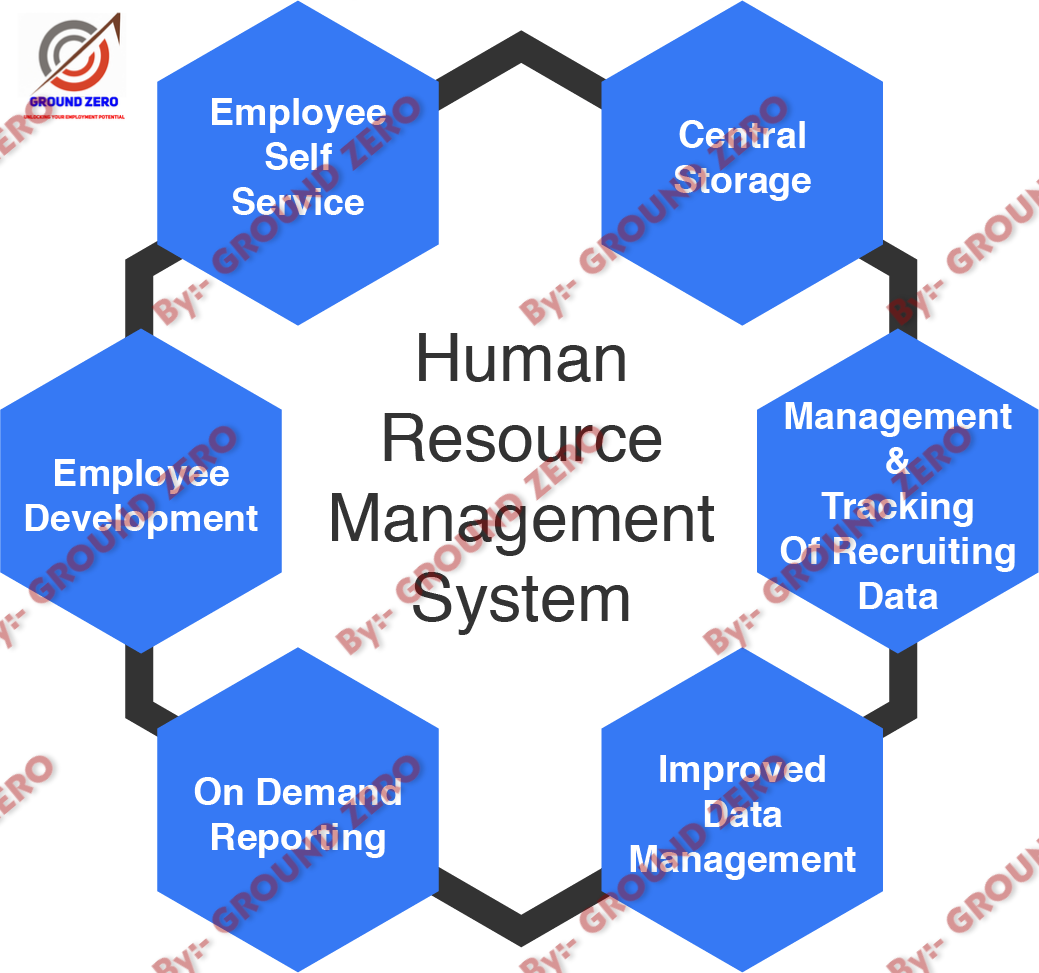

So, organisations need to stay on top of all these details. One thing that can aid you in the process is technology. HR software plays a very important role in helping organisations in complying with different laws.

In this blog, we are going to understand different compliance challenges that HR teams usually face, how HR management software can help them in the process and much more.

Understanding Compliance Challenges in HR:-

The HR compliance issues are multifaceted. They can stem because of labour laws, balance employee rights with organisational interests and the complexity of managing diverse workforces.

Some of the most common compliance challenges that most HR teams face are:

- Legal and Regulatory Compliance: The labour laws are ever-changing and vary from one state to another. If an organization have multiple branches spread across different states and countries, it becomes very tough to stay updated with the local laws of all branches. Most of these rules are related to wages, hours of work, anti-discrimination, workplace safety, medical leave, etc.

- Diversity: Ensuring that the organization is diverse and inclusive isn’t just a moral responsibility. It is a legal requirement for every organization. HR teams need to ensure that the hiring, promoting, firing, and all the other processes in an organization are happening without any bias. They have to follow through on every decision that has been made by team leads and heads of departments to maintain a bias-free environment in the organization.

- Data Privacy and Security: HR departments have access to a substantial amount of confidential information related to employees, including their personal and financial data. It is important for them to stay compliant with various data privacy laws like General Data Protection Regulation (GDPR) and Health Insurance Portability and Accountability Act (HIPAA). They must implement robust data protection systems in the organizations and get the necessary consent from employees.

- Workplace Safety and Health: HR teams are responsible to ensure proper workplace safety for all employees. The Occupational Safety and Health Administration regulations require the management to provide appropriate training and protection equipment as per the requirement.

- Employee Compensation: Every state has different rules when it comes to employee compensation. It is important for an organization to follow the minimum wage rule, classify the employees into tax-exempt and non-exempt, follow the overtime rules, etc. Misclassifying employees or not compensating them fairly can lead to several legal issues.

- Termination and Layoffs: Terminating employees during the downsizing process requires compliance with multiple laws, severance pay and various other details. Mishandling any of these processes can lead to a myriad of cases regarding wrongful termination.

Types of Global HR Compliance:-

Global HR Compliance comprises three key aspects: statutory, regulatory and contractual.

1. Statutory compliance

This refers to complying with labor law legislation set by a country’s governing bodies at the local, state, and federal levels. These labor and employment laws cover various aspects, including minimum wages, tax deductions, minimum working age, working hours, and mandatory employee benefits.

Non-compliance with these statutes can expose organizations to legal risks, financial penalties, and reputation damage. To mitigate risks and maintain stability, organizations must ensure their HR policies and procedures align with current laws.

2. Regulatory compliance

This involves adhering to the rules and guidelines set by regulatory bodies overseeing certain industries or sectors within a region or country. For example, the Health and Safety Executive in the U.K. and the Occupational Safety and Health Administration in the U.S. lay down specific mandates for a safe work environment and prevention of accidents or health hazards. Regulatory compliance helps organizations retain operational licenses, avoid sanctions, and operate ethically and responsibly.

3. Contractual compliance

Contractual compliance involves adhering to the terms and conditions outlined in employment contracts, ensuring the fulfilment of obligations to employees.

Non-compliance with contractual obligations can result in employee claims and legal action, financial penalties, and reputational damage.

Companies are free to include any terms and conditions in their contractual agreements as long as they do not violate any legal and regulatory requirements in the respective jurisdictions.

What Compliance Challenges Arise When Hiring Globally?

HR compliance issues may arise anywhere in the employee lifecycle from hiring to retirement or termination. Here are some of the common HR compliance issues,

1. Employee misclassification

Classifying permanent employees as independent contractors affects their pay, tax responsibilities, rights, and benefits. Employee misclassification occurs when a company incorrectly labels a worker as an independent contractor instead of an employee, or vice versa. This misclassification deprives workers of the compensation and protections they are legally entitled to.

In the United States, the Fair Labour Standards Act (FLSA) provides guidelines for classifying workers. Misclassification leads to significant risks that include legal penalties and cause reputational damage. In a recent report, Uber and Lyft were accused of dodging over $266 million in benefit contributions by misclassifying drivers as independent contractors.

The report states that this misclassification allowed these companies to evade the employee’s payments into the state’s employee protection programs including employee compensation, unemployment insurance, and paid family leave. This situation highlights the financial implications that arise from worker misclassification.

How to mitigate the risks of employee misclassification?

Regularly review the country’s legislation and consult with legal experts to ensure worker classification is compliant with the current laws

Develop and implement clear policies regarding worker classification and provide training for the HR management on proper classification procedures.

Conduct regular audits to identify and correct any misclassifications

2. Violating compensation laws

Compensation laws govern various types of employee remuneration, including minimum wages, gratuity, 13th-month pay, and annual bonuses. Each type ensures fair compensation for employees and is subject to specific legal requirements in different countries.

In India, the Payment of Gratuity Act, of 1972, mandates that employers provide gratuity to employees who have completed at least five years of service upon their resignation, retirement, or death. In the Philippines, the 13th month of pay is mandated by Presidential Decree 851, which requires all private-sector employers to provide this benefit to their employees. An example of a violation is seen in the Philippines where some companies fail to provide the mandatory 13th-month pay, leading to legal actions and compliance orders issued by the Department of Labor and Employment (DOLE). Non-compliant companies may face garnishment of their accounts and other legal consequences to ensure employees receive their entitled compensation.

How to mitigate the risks of violating compensation laws?

Always research and stay updated on the compensation laws in each jurisdiction where your company operates. This includes understanding minimum wage requirements, overtime regulations, pay equity laws

Regularly review and update payroll systems to reflect current minimum wage laws. This can be done using global payroll automation software. These SaaS-based platforms can be seamlessly updated to reflect regulatory changes, ensuring compliance with local laws. Additionally, they guarantee accurate salary calculations, correct disbursements, and timely payments, streamlining the payroll process across different regions.

Educate HR and payroll staff about the local legal requirements for various types of compensation.

Conduct periodic compensation practices audits to proactively identify and rectify non-compliance issues.

3. Workplace disasters

Workplace disasters include a broad range of events that cause risk to the employees’ health, safety and well-being. These can include accidents, chemical exposures, fires, structural collapses, and more. Each country has its laws and regulations to ensure the health and safety of workers.

For example in the United States, the Occupational Safety and Health Administration (OSHA) sets standards for hazard communication, respiratory protection, and fall prevention. Similarly, the United Kingdom’s Health and Safety Executive (HSE) mandates risk assessments and safety training to prevent workplace accidents. Australia’s Work Health and Safety Act (WHS) emphasizes consultation and cooperation between employers and employees to maintain a safe work environment.

How to mitigate the risk of workplace disasters?

Conduct regular risk assessments to identify and mitigate hazards

Implement comprehensive safety programs for all employees

Develop and practice emergency response plans to ensure swift an effective action in crisis situations.

4. Discrimination

Several U.S. laws regulate discrimination in hiring including the Fair Labor Standards Act (FLSA), Title VII of the Civil Rights Act of 1964, and the American Disabilities Act (ADA) of 1990. The Equality Act of 2010, Disability Discrimination Act of 1995 in the UK, the Sex Discrimination Act of 1984, Racial Discrimination Act of 1975 in Australia all prohibit discrimination based on race, color, religion, sex, origin, or disabilities in all areas of public life including employment. These laws aim to create a fair and equitable workplace where all employees have equal opportunities and are protected from bias and discriminatory practices.

How to mitigate the risk of discrimination?

Implement comprehensive anti-discriminatory policies that prohibit discrimination and promote diversity and inclusion within the company

Provide mandatory training for all the employees and management on recognizing and preventing discrimination

Create secure and accessible channels for employees to report discrimination and ensure prompt action is taken on the complaints against the violators.

5. Data Protection and Privacy Risks

Employees’ personal and employment information such as job applications, resumes, tax forms, bank information, information should be maintained properly with sufficient security. It must be accessible only by authorized individuals within your organization.

Data protection and privacy laws vary by jurisdiction and encompass much more than cybersecurity. In Europe, the General Data Protection Regulation (GDPR) governs data protection and privacy, while the California Consumer Privacy Act (CCPA) sets similar standards in California.

Data breaches can lead to severe consequences, including identity theft, financial fraud, and legal liabilities for the organization. For example, Amazon was fined €32 million ($34.8 million) for monitoring employee performance through scanners by France’s National Commission on Informatics and Liberty (CNIL) for excessive surveillance of its workers, which violated GDPR principles.

How to mitigate the data protection and privacy risks?

Encrypt all stored and transmitted employee data to prevent unauthorized access to employees’ personal and health-related information.

Perform regular audits and risk assessments of HR systems and databases to identify vulnerabilities and ensure compliance with data protection regulations.

Educate employees about the importance of safeguarding sensitive information, including best practices for password management and recognizing phishing attempts.

6. Violating Benefits laws

Various benefits laws protect employees’ rights and ensure they receive essential benefits. The key benefits include maternity leave, paid sick leave, employer insurance and social security contributions.

In Australia, for example, the Fair Work Act 2009 provides guidelines for various employee benefits including paid sick leave and paternal leave, while the Superannuation Guarantee Act 1992 mandates that employers contribute to their employees’ superannuation retirement funds, ensuring employees have financial support in retirement.

In May 2024, a worker in Ireland won a case against his employer for breaching the Sick Leave Act and was awarded €1,400. The Workplace Relations Commission (WRC) ruled that the employer had violated the worker’s rights by disciplining him for taking statutory sick leave.

How to mitigate the risk of violating benefit laws?

Regularly update company policies in consultation with legal experts and ensure compliance

Provide clear information about the benefits applicable to employees in company policies.

Establish procedures for handling benefits claims and disputes to ensure fair and lawful treatment of employees.

Utilize global HR management systems, which can be tailored to ensure compliance with local laws and regulations.

Related

Discover more from Ground Zero

Subscribe to get the latest posts sent to your email.