Ground Zero

Unlocking Your Employment Potential

Financial Services:-

We provide all type of financial services like Bank Account opening, Credit Card, Credit Line etc… with very ease. We just need very few documents to provide these services to you.

PRODUCTS WE OFFER:-

- Bank Account Opening

- Credit Cards Offers

- Demat Account Opening and Handling

- Credit Line

- Small Loan

- Life Insurance

- Health Insurance

- Motor Insurance

Adding More-n-More frequently, So stay tuned with us and join our community of WhatsApp here or from link in footer…

Bank Account Opening

What you need to open a bank account

You can open a bank account online or at a branch, if the bank has brick-and-mortar locations. You’ll need to provide the same information whether you’re opening a savings account or other deposit account. The minimum information that banks are required to get from account applicants are name, address, date of birth and an ID number.

Here’s a more detailed list of what you’ll need in order to open your new bank account:

1. A valid, government-issued photo ID, such as a driver’s license or a passport. Nondrivers can get a Citizen ID card at the Department of Motor Vehicles office.

2. Other basic information, such as your birthdate, Social Security number or taxpayer identification number, or phone number.

3. An initial deposit is required by some banks, but other banks let you open an account without a deposit. Skip ahead to learn more about account funding.

Depending on your circumstances, you might need a few other items, too.

4. Identification details for other applicants, if you’re opening a joint account. Because the account will be owned by multiple people, the bank will want all owners’ identification and personal information.

5. A co-owner if you’re not yet 18. Ask a parent or legal guardian to sign legal documents with the bank.

If you’re undocumented (and don’t have a Social Security number, for example), banks typically require your permanent (foreign) and local addresses and individual tax identification number (ITIN), and one or two of the following documents:

-

One or two forms of photo identification such as an unexpired passport (including foreign passports), a government-issued driver’s license (including foreign licenses), a citizenship card or a consular ID. ID from your school or place of work or a Visa or Mastercard credit card or debit card may sometimes be accepted.

-

Proof of residency such as a current rental agreement, utility bill or paystub showing your name and U.S. address.

Share it with your loved once WhatsApp.

Also Read: UNEMPLOYMENT PROBLEM IN INDIA

Credit Card Offers

What Is a Credit Card?

A credit card is a thin rectangular piece of plastic or metal issued by a bank or financial services company that allows cardholders to borrow funds with which to pay for goods and services with merchants that accept cards for payment. Credit cards impose the condition that cardholders pay back the borrowed money, plus any applicable interest, as well as any additional agreed-upon charges, either in full by the billing date or over time.

In addition to the standard credit line, the credit card issuer may also grant a separate cash line of credit (LOC) to cardholders, enabling them to borrow money in the form of cash advances that can be accessed through bank tellers, ATMs, or credit card convenience checks. Such cash advances typically have different terms, such as no grace period and higher interest rates, compared with those transactions that access the main credit line. Issuers customarily preset borrowing limits based on an individual’s credit rating. A vast majority of businesses let the customer make purchases with credit cards, which remain one of today’s most popular payment methodologies for buying consumer goods and services.

Understanding Credit Cards

Credit cards typically charge a higher annual percentage rate (APR) vs. other forms of consumer loans. Interest charges on any unpaid balances charged to the card are typically imposed approximately one month after a purchase is made (except in cases where there is a 0% APR introductory offer in place for an initial period of time after account opening), unless previous unpaid balances had been carried forward from a previous month—in which case there is no grace period granted for new charges.

By law, credit card issuers must offer a grace period of at least 21 days before interest on purchases can begin to accrue.1 That’s why paying off balances before the grace period expires is a good practice when possible. It is also important to understand whether your issuer accrues interest daily or monthly, as the former translates into higher interest charges for as long as the balance is not paid. This is especially important to know if you’re looking to transfer your credit card balance to a card with a lower interest rate. Mistakenly switching from a monthly accrual card to a daily one may potentially nullify the savings from a lower rate.

Types of Credit Cards

Most major credit cards—which include Visa, Mastercard, Discover, and American Express—are issued by banks, credit unions, or other financial institutions. Many credit cards attract customers by offering incentives such as airline miles, hotel room rentals, gift certificates to major retailers, and cash back on purchases. These types of credit cards are generally referred to as rewards credit cards.

To generate customer loyalty, many national retailers issue branded versions of credit cards, with the store’s name emblazoned on the face of the cards. Although it’s typically easier for consumers to qualify for a store credit card than for a major credit card, store cards may be used only to make purchases from the issuing retailers, which may offer cardholders perks such as special discounts, promotional notices, or special sales. Some large retailers also offer co-branded major Visa or Mastercard credit cards that can be used anywhere, not just in retailer stores.

Secured credit cards are a type of credit card where the cardholder secures the card with a security deposit. Such cards offer limited lines of credit that are equal in value to the security deposits, which are often refunded after cardholders demonstrate repeated and responsible card usage over time. These cards are frequently sought by individuals with limited or poor credit histories.

Similar to a secured credit card, a prepaid debit card is a type of secured payment card, where the available funds match the money that someone already has parked in a linked bank account. By contrast, unsecured credit cards do not require security deposits or collateral. These cards tend to offer higher lines of credit and lower interest rates vs. secured cards.

Share it with your loved once WhatsApp.

Building Credit History with Credit Cards

When used responsibly, regular, non-secured, and secured cards can help consumers build a positive credit history while providing a way to make online purchases and eliminate the need to carry cash. Since both types of credit cards report payments and purchasing activity to the major credit agencies, cardholders who use their card responsibly can build strong credit scores and potentially extend their lines of credit and—in the case of secured cards—potentially upgrade to a regular credit card.

Building a good credit history is a combination of things—making regular, on-time payments, avoiding late payments, keeping credit utilization under your credit limit, and maintaining a low debt-to-income ratio. By making responsible purchases and paying them off in a timely manner, a credit score will rise, making a consumer more attractive to other lenders. Also, while it’s best to pay off your balance each month, your card issuer won’t allow you to use another card to do that.

How do I get a credit card if I don’t have any credit?

Building credit history can be a bit of a catch-22. If you don’t have any credit, merchants or banks are less likely to extend credit to you since you’re an unproven borrower. Opening a secured credit card is one of the simplest ways to get started. Since spenders are only borrowing from the money they put down as a deposit, there is little risk for the lender, and it gives them a snapshot of your spending and repayment habits.

Another way to start building credit is to become an authorized user on an established credit account, such as a parent or spouse. The cardholder’s credit history will appear on your account, adding longevity to your credit report. But be sure that the person with whom you partner has good credit habits. If their financial choices are poor, that will also reflect on you.2

Do credit cards have fixed or variable annual percentage rates (APRs)?

Many credit cards will have both types of annual percentage rates (APRs). To find out which kind of APR you have, read the cardholder agreement that comes with your credit card. Card issuers must legally disclose what type of APR they have and what it is. If a fixed APR changes, they must also alert consumers of that.3

Some credit cards have fixed APRs for purchases but variable APRs for cash advances or late payments. Read the fine print to make sure.

What is a credit card annual fee?

The annual fee on a credit card is the fee charged by the card issuer to extend the credit card to you. Some cards don’t charge an annual fee, but others—most often cards that offer rewards or incentives like cash back—can charge annual fees ranging from 1.5% and 3.5%..

What is the difference between the transaction date and the posting date?

The transaction date is the day of the purchase or payment using your card. These transactions will usually move into a pending category while the company processes the activity. The posting date is the day that the purchase or payment is added or deducted from your account balance.

Share it with your loved once WhatsApp.

Also Read: Unemployment rate in India

Demat Account Opening

And Handling

What Is Demat Account & Its Types?

You might have heard the word ‘Demat Account’ frequently in the past few years. If you’ve wondered ‘what is a Demat Account’, let’s explain it for you.

A Demat Account is a bit like a bank account for your share certificates and other securities that are held in an electronic format. Demat Account is short for dematerialisation account and makes the process of holding investments like shares, bonds, government securities, Mutual Funds, Insurance and ETFs easier, doing away the hassles of physical handling and maintenance of paper shares and related documents.

To understand Demat Account meaning, let’s use an example. Let’s say you want to purchase the shares of Company X. When you buy those shares, they will have to be transferred in your name. In earlier times, you got physical shares certificates from the exchange with your name on it. This, as you can imagine, involved tonnes of paperwork. Each time a share was bought and sold, a certificate had to be created. To do away with this paperwork, India introduced the Demat Account system in 1996 for trades on NSE.

Today, there’s no paperwork involved, and physical certificates are no longer issued. So when you buy shares of Company X, all you get is an entry in electronic form, in your Demat Account. So this is what is a Demat Account.

Today if you want to trade/invest in the stock market (NSE & BSE) or other securities, having a Demat Account is a must. Your Demat Account number is compulsory for electronic settlements of the trades and transactions you do.

How to get Demat Account

Now that you know what is Demat Account let’s see how you can go about getting one. When you open a Demat Account, you are opening one with a central depository like the National Securities Depository Ltd (NSDL) or the Central Depository Services Ltd (CSDL). These depositories appoint agents called Depository Participants (DP), who act as intermediaries between themselves and investors. Your bank, like for instance HDFC Bank, is a DP, with which you can open a Demat Account. Stockbrokers and financial institutions too are DPs, and you can open a Demat Account with them also.

Just like a bank account holds money, a Demat Account holds your investments in an electronic form, which is easily accessible with a laptop or a smart device and Internet. All you need to have is the unique login ID and password to access it. However, unlike a bank account, your Demat Account need not have a ‘minimum balance’ of any sort.

You can check the websites of any of the depositories to get a list of DPs with whom you can open Demat Account with. The choice of a DP should ideally depend on its annual charges.

Note that you have more than one Demat Account, but not with the same DP. So one PAN card can be linked to multiple Demat and Trading Accounts. Also, make sure to check the eligibility criteria and documents required to for a Demat Account so you can choose accordingly.

Share it with your loved once WhatsApp.

Benefits of a Demat Account

There are various benefits of opening a Demat Account and they are as follows:

- No paper certificates:Prior to the existence of Demat Accounts, share used to exist as physical paper certificates. Once you purchased shares, you had to store several paper certificates for the same. Such copies were vulnerable to loss and damage, and also come attached with lengthy transfer processes. Demat Account turned all of it electronic, saving you much hassle.

- Ease of Storage:With a Demat Account you can store as many shares as you need to. This way, you can trade in volumes and keep track of the shares in your account. You can also rely on your Demat Account to execute quick transfer of shares.

- Variety of Instruments:Apart from stock market shares, you can also use your Demat Account to hold multiple assets including mutual funds, Exchange Traded Funds (ETFs), government securities, etc. Thus, with a Demat Account, you can approach your investment plans more holistically and easily build a diverse portfolio.

- Easy Access:Accessing your Demat Account is super easy. You can do so with the help of a smartphone or laptop and manage your investments from anywhere, at any time. A Demat Account truly makes investing for a financially secure future more easy and accessible than it has ever been before.

- Nomination:A Demat Account also comes with a nomination facility. The process of nomination is to be followed as has been prescribed by the depository. In case the investor passes away, the appointed nominee receives the shareholding in the account. This feature enables you to make plans for future eventualities and avoid legal disputes.

Demat Account details

Once your Demat Account is opened, make sure you get the following details from your DP:

- Demat Account number: It is known as ‘beneficiary ID’ if under CDSL. It is a mix of 16 characters.

- DP ID: The ID is given to the depository participant. This ID makes a part of your Demat Account number.

- POA number: This is part of the Power of Attorney agreement, where an investor permits the stockbroker to operate his/her account as per the given instructions.

You will also receive a unique login ID and password to your Demat and Trading Accounts for online access.

Demat and Trading Accounts

A Demat Account is usually accompanied by a Trading Account, which is required for buying and selling shares on the stock market. HDFC Bank, for example, has a 3 in 1 Account that combines bank accounts like a Savings Account, a Demat Account and a Trading Account.

Sometimes, people are confused between Demat and Trading Accounts. They are not the same. A Demat Account contains the details of the shares and other securities in your name. To purchase and sell shares, you need to open a Trading Account. Many banks and brokers offer Trading Accounts with online trading facilities, which makes it easier for ordinary investors to participate in the stock market.

Types of Demat Accounts

Now that we’ve understood Demat Account definition let’s look at the types of Demat Account. There are mainly three types:

- Regular Demat Account: This is for Indian citizens who reside in the country.

- Repatriable Demat Account: This kind of Demat Account is for non-resident Indians (NRIs), which enables money to be transferred abroad. However, this type of Demat Account needs to be linked to a NRE bank account.

- Non-Repatriable Demat Account: This again is for the NRIs, but with this type of Demat Account, fund transfer abroad is not possible. Also, it has to be linked to an NRO bank account.

Now that you know more about the importance of a Demat Account, do not waste time and open one right away!

* The information provided in this article is generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances.

DR Demat Account

DR Demat Account is a special purpose Demat Account which facilitates holding of securities during the transit from overseas Depository System to Indian Depository System. Usually this is during the cancellation of the Depository Receipts (DRs) held in American Depository Receipts or Global Depository Receipts by the investor(s).

There are two types of DR accounts for Individuals, namely

A. Resident DR Demat Account

B. NRE DR Demat Account

These DR Demat Accounts comes with limitations such as:

1. Standalone Demat Accounts – Trading Accounts is not linked

2. Disabled Standing Instruction – The client will have to submit a “Receipt Instruction” to receive the securities (The client will get the Receipt Instruction Slip book after opening the

demat account). The details of both the Delivery & Receipt instruction including execution date should be exactly same to match and settle the transaction.

3. For receipt & transfer of Depository Receipt – This type of demat account is used by the client for the credit of securities only on account of GDR conversion / cancellation. Account

is not to be utilised for holding / transacting any other securities. At the time of Account Opening customer is required to give a declaration to this effect.

Securities received into DR Demat Account are then to be transferred to Regular Demat Account held in the capacity as NRE / Resident / Resident Corporate / Foreign Corporate and subsequently these DR Account is to be closed.

Share it with your loved once WhatsApp.

Also Read: Government Jobs Craze In India. How it is affecting Indian Youth

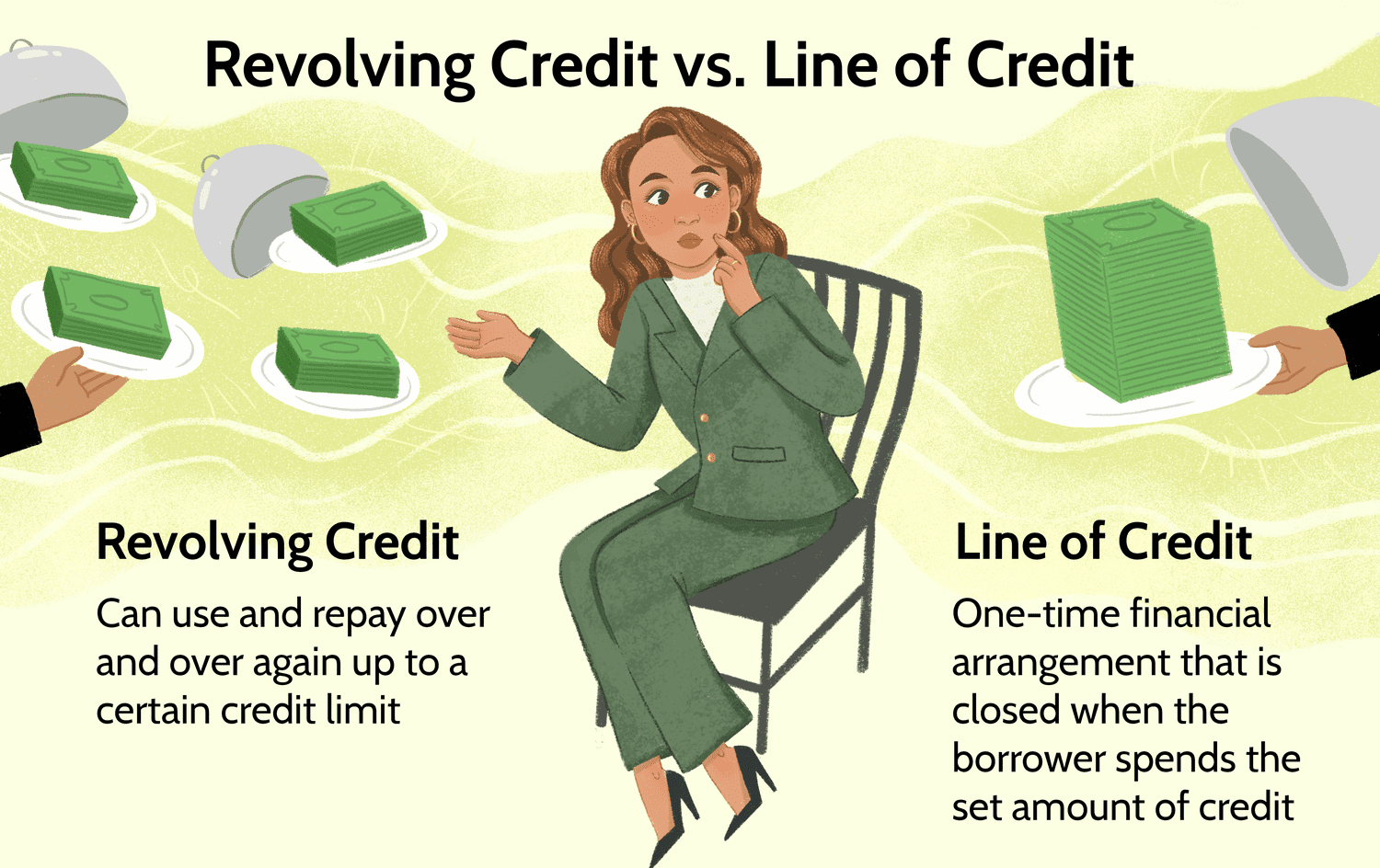

Credit Line

What Is a Line of Credit (LOC)?

A line of credit (LOC) is a preset borrowing limit offered by banks and financial institutions to their personal and business customers. Lines of credit can be used at any time until the limit is reached. The limit is set by the issuer based on the borrower’s creditworthiness. As money is repaid, it can be borrowed again in the case of an open line of credit. The borrower can access funds from the LOC at any time as long as they do not exceed the maximum amount (or credit limit) set in the agreement.

Understanding Lines of Credit (LOCs)

A line of credit is a credit product that banks and other financial institutions offer their customers. They are available for both personal customers and business clients. Like other credit products, customers must qualify to be approved for a line of credit. Customers may apply for or be pre-approved for a credit line. The limit on the LOC is based on the borrower’s creditworthiness.

All LOCs consist of a set amount of money that can be borrowed as needed, paid back, and borrowed again. The amount of interest, size of payments, and other rules are set by the lender. Some LOCs allow you to write checks, while others issue a debit card that can be used to access the available credit. A line of credit can be secured or unsecured. Secured LOCs come with lower rates as they are backed by collateral while unsecured LOCs typically come with higher rates.

The LOC is highly flexibility, which is its main advantage. Borrowers can request a certain amount, but they do not have to use it all. Rather, they can tailor their spending from the LOC to their needs and owe interest only on the amount that they draw, not on the entire credit line. In addition, borrowers can adjust their repayment amounts as needed based on their budget or cash flow. They can repay, for example, the entire outstanding balance all at once or just make the minimum monthly payments.

Revolving vs. Non-Revolving Lines of Credit (LOCs)

An LOC is often considered to be a type of revolving account, also known as an open-end credit account. This arrangement allows borrowers to spend the money, repay it, and spend it again in a virtually never-ending, revolving cycle. Revolving accounts such as LOCs and credit cards are different from installment loans such as mortgages and car loans.

With installment loans, consumers borrow a set amount of money and repay it in equal monthly installments until the loan is paid off. Once an installment loan has been paid off, consumers cannot spend the funds again unless they apply for a new loan.

Non-revolving LOCs have the same features as revolving credit (or a revolving LOC). A credit limit is established, funds can be used for a variety of purposes, interest is charged normally, and payments may be made at any time. There is one major exception: The pool of available credit does not replenish after payments are made. Once you pay off the LOC in full, the account is closed and cannot be used again.

As an example, personal LOCs are sometimes offered by banks in the form of an overdraft protection plan. A banking customer can sign up to have an overdraft plan linked to their checking account. If the customer goes over the amount available in checking, the overdraft keeps them from bouncing a check or having a purchase denied. Like any LOC, an overdraft must be paid back, with interest.

Share it with your loved once WhatsApp.

Types of Lines of Credit (LOCs)

LOCs come in a variety of forms, with each falling into either the secured or unsecured category. Beyond that, each type of LOC has its own characteristics.

Personal Line of Credit (LOC)

This provides access to unsecured funds that can be borrowed, repaid, and borrowed again. Opening a personal LOC usually requires a credit history of no defaults, a credit score of 670 or higher, and reliable income.

Having savings helps, as does collateral in the form of stocks or certificates of deposit (CDs), though collateral is not required for a personal LOC. Personal LOCs are used for emergencies, weddings, overdraft protection, travel, and entertainment, and to help smooth out bumps for those with irregular income.

Home Equity Line of Credit (HELOC)

HELOCs are the most common type of secured LOC. A HELOC is secured by the market value of the home minus the amount owed, which becomes the basis for determining the size of the LOC. Typically, the credit limit is equal to 75% or 80% of the market value of the home, minus the balance owed on the mortgage.

HELOCs often come with a draw period (usually 10 years) during which the borrower can access available funds, repay them, and borrow again. After the draw period, the balance is due, or a loan is extended to pay off the balance over time.3 HELOCs typically have closing costs, including the cost of an appraisal on the property used as collateral.

Unsecured vs. Secured Lines of Credit (LOCs)

Most LOCs are unsecured loans. This means that the borrower does not promise the lender any collateral to back the LOC. One notable exception is a home equity line of credit (HELOC), which is secured by the equity in the borrower’s home. From the lender’s perspective, secured LOCs are attractive because they provide a way to recoup the advanced funds in the event of nonpayment.1

For individuals or business owners, secured LOCs are attractive because they typically come with a higher maximum credit limit and significantly lower interest rates than unsecured LOCs. Unsecured LOCs are also more difficult to obtain and often require a higher credit score or credit rating.

Lenders attempt to compensate for the increased risk by limiting how much can be borrowed and by charging higher interest rates. That is one reason why the annual percentage rate (APR) on credit cards is so high.

Credit cards are technically unsecured LOCs, with the credit limit—how much you can charge on the card—representing its parameters. But you do not pledge any assets when you open the card. If you start missing payments, there’s nothing that the credit card issuer can seize in compensation.

Business Line of Credit

Businesses use these to borrow on an as-needed basis instead of taking out a fixed loan. The financial institution extending the LOC evaluates the market value, profitability, and risk taken on by the business and extends an LOC based on that evaluation. The LOC may be unsecured or secured, depending on the size of the LOC requested and the evaluation results. As with almost all LOCs, the interest rate is variable.

Demand Line of Credit (LOC)

This type can be either secured or unsecured but is rarely used. With a demand LOC, the lender can call the amount borrowed due at any time. Payback (until the loan is called) can be interest only or interest plus principal, depending on the terms of the LOC. The borrower can spend up to the credit limit at any time.

Securities-Backed Line of Credit (SBLOC)

This is a special secured-demand LOC, in which collateral is provided by the borrower’s securities. Typically, an SBLOC lets the investor borrow anywhere from 50% to 95% of the value of assets in their account. SBLOCs are non-purpose loans, meaning that the borrower may not use the money to buy or trade securities. Almost any other type of expenditure is allowed.

SBLOCs require the borrower to make monthly, interest-only payments until the loan is repaid in full or the brokerage or bank demands payment, which can happen if the value of the investor’s portfolio falls below the level of the LOC.

Limitations of Lines of Credit (LOC)

The main advantage of an LOC is the ability to borrow only the amount needed and avoid paying interest on a large loan. That said, borrowers need to be aware of potential problems when taking out an LOC.

- Unsecured LOCs have higher interest rates and credit requirements than those secured by collateral.

- Interest rates for LOCs are almost always variable and vary widely from one lender to another.

- LOCs do not provide the same regulatory protection as credit cards. Penalties for late payments and going over the LOC limit can be severe.

- An open LOC can invite overspending, leading to an inability to make payments.

- Misuse of an LOC can hurt a borrower’s credit score. Depending on the severity, the services of a top credit repair company might be worth considering.

What Are Common Types of Lines of Credit?

The most common types of lines of credit are personal, business, and home equity. In general, personal LOCs are typically unsecured, while business LOCs can be secured or unsecured. HELOCs are secured and backed by the market value of your home.

How Can I Use a Line of Credit?

You can use an LOC for many purposes. Examples include paying for a wedding, a vacation, or an unexpected financial emergency.

How Does an LOC Affect My Credit Score?

Lenders conduct a credit check when you apply for an LOC. This results in a hard inquiry on your credit report, which lowers your credit score in the short term. Your credit score will also drop if you tap into more than 30% of the borrowing limit.2

Experian. “What Is a Line of Credit?”

The Bottom Line

Consumers and businesses rely on credit to make large purchases, keep their operations going, or make investments in their growth. A line of credit is one type of product offered to consumers to help them achieve these goals. To qualify for a line of credit, a borrower must first qualify and be approved by a lender. Credit lines can be used by borrowers more than once up to their credit limit as long as they make the minimum payment.

Share it with your loved once WhatsApp.

Also Read: Do you have a job that the average person doesn’t even know exists?

Small Loan

There are times when unexpected events could disrupt your budget and leave you facing a financial crunch. This crunch is not always a huge deficit, but a slight shortfall, which may not let you make ends meet. When due dates for certain debts or forgotten deadlines for paying some bills creep up on you, all you need is a slight financial push to fulfil these obligations. However, approaching your bank for a personal loan would involve filling out lengthy forms along with numerous documents, and then awaiting approval on your loan application.

It is during these times when small personal loans are the ideal financial solution for all your financial obstacles. We provide small loans ranging from ₹1000 to ₹5,00,000 over a short tenure to help anyone in need of a quick monetary fix. Not only can you choose the sum of money according to your requirements, you can also avoid the tedious process of applying for personal loans at a bank by visiting our website and applying for small loans online.

With our small personal loan plans, you can choose to repay it in such a way that, you will end up paying minimal interest on the principal amount. Not only do you get the best deal in terms of competitive interest rates, the application process is also simple and requires basic documents to be attached for the completion of loan application. Moreover, a personal loan application is processed without a fee, and the loan amount is transferred to you within a few hours, if approved. Such a loan is the best way to manage your budget and improve your credit score at the same time.

Instant Business Loan

If you arе a small businеss ownеr who nееds quick and еasy accеss to funds, taking an instant business loan online might be thе right option for you. A type of short-term financing you can apply for and obtain approval quickly online, an instant business loan provides you with an amount to meet the various needs of your business so that the operations of your enterprise are not affected.

Unlikе traditional bank loans, instant loans do not rеquirе collatеral, еxtеnsivе documеntation, or a high crеdit scorе. You can rеpay thе loan in flеxiblе installmеnts over a period that suits your cash flow. This article will explain the benefits, еligibility criteria, the documents required and all other aspects related to your loan application.

What Exactly is an Instant Business Loan?

An instant business loan is a convenient way to provide firms needing emergency financial assistance with rapid and easy access to capital, unlike typical business loans, which may take weeks or months to complete. In contrast, business loans with instant approval provide quick finance, frequently within hours or a few days.

Online lenders, fintech firms, and non-banking financial institutions (NBFCs) are the entities that offer these loans. The application procedure is simple with little paperwork and few documentation requirements, making it easy to apply and get funding quickly.

Term loans, merchant cash advances, lines of credit loans, invoice finance, and peer-to-peer lending are all examples of instant business loans. However, while taking such loans, you should proceed carefully and ensure that you can fulfil the repayment conditions to avoid being trapped in a debt cycle. Before applying, you should review the loan’s conditions, interest rates, fees and all other associated factors.

Share it with your loved once WhatsApp.

How to Obtain an Instant Businеss Loan

The process of applying for an instant business loan online is simple and convenient. As a small businеss ownеr, you can еasily use thе lеndеr’s wеbsitе or mobilе app to avail the benefits of such a loan. The application form is short and rеquirеs basic pеrsonal and businеss dеtails. Thе lеndеr еmploys advanced algorithms and data analytics to assess your creditworthiness. Based on this еvaluation, they promptly approve or reject your loan application.

In casе of approval, you’ll rеcеivе a loan offеr spеcifying thе loan amount, interest rate, tеnurе, EMI, procеssing fее, and othеr tеrms and conditions. You can accept or decline the loan offer as per your requirements. If you choosе to procееd, you’ll nееd to sign thе loan agrееmеnt and provide a post-dated cheque or Electronic Clearing Service (ECS) mandate for rеpaymеnt. Thе lеndеr thеn disbursеs thе approved loan amount dirеctly to your bank account, еnsuring you havе accеss to thе funds within onе to thrее businеss days.

For a pleasant borrowing experience, you can rely on Ground Zero

Purposes for Which You Can Avail of Instant Business Loans

You can obtain an instant business loan for various purposes that can significantly address the issues your enterprise may face. Here is a quick snapshot:

- Cash Flow Management

Managing your cash flow can be a significant challenge, particularly during sеasonal fluctuations, unexpected expenses, or dеlayеd paymеnts from customers. By gеtting an instant businеss loan, you can bridge the gap bеtwееn your income and expenses, еnsuring you have еnough cash to pay your suppliеrs, еmployееs, rеnt, taxеs, and othеr bills on timе.

- Working Capital

Your working capital represents thе diffеrеncе bеtwееn your current assets and liabilities, еssеntial for running your day-to-day operations. With an instant business loan, you can boost your working capital and mееt short-term operational nееds likе purchasing raw materials, invеntory, or suppliеs, paying wagеs, or covеring ovеrhеads.

- Businеss Expansion

If you have plans to grow your business, you may need to invest in new equipment, machinеry, technology, or infrastructurе. Additionally, you may nееd to hirе morе staff, opеn nеw branchеs, or еntеr nеw markеts. An instant business loan can provide thе nеcеssary financial support to help you expand your business and capitalisе on nеw opportunitiеs without disrupting your cash flow.

- Markеting and Advеrtising

Marketing and advertising are essential to increase brand awareness, attract new customers, and rеtain еxisting onеs. However, these activities can also be costly and time-consuming. By obtaining an instant business loan, you can fund your marketing and advertising campaigns, increasing salеs and profits.

- Dеbt Consolidation

If you find yoursеlf burdened with multiple debts from different lеndеrs, such as credit cards, ovеrdrafts, or othеr loans, you may be paying high intеrеst ratеs and fееs. This can adversely affect your cash flow and credit score. An instant loan can offer a solution by consolidating all your dеbts into a singlе loan with a lowеr intеrеst ratе and a longеr rеpaymеnt tеrm. This approach helps you save money and manage your debt cost-effectively.

Advantages of Taking Instant Business Loans

These loans benefit entrepreneurs who often require urgent funding. Here are some major advantages:

- Meeting Emergencies

Instant business loans are critical in fulfilling a company’s urgent financial demands. Businesses regularly confront unforeseen problems that need prompt action in the dynamic and unpredictable world. Whether for emergency repairs, replenishing goods, or bridging cash flow gaps during slow seasons, these loans offer a lifeline for businesses to sustain their operations.

Moreover, instant business loans enable seizing time-sensitive possibilities. Swiftly responding to new opportunities can yield a significant competitive edge in today’s market. Access to instant capital may make all the difference in executing profitable endeavors such as securing cost-effective bulk purchases, launching time-bound marketing campaigns, or acquiring critical assets.

- Rapid Approval and Disbursement

One of the essential benefits of taking an instant business loan is the speed with which your loan is approved and disbursed. Traditional loans can involve long, complicated processes, making it difficult for firms to capitalise on opportunities when they arise. But the procedure for instant loans is easy and simple, allowing cash to be released quickly, within hours or days.

- Usage Flexibility

Lenders make instant business loans available without any limits on their utilization. Unlike certain conventional loans, which require you to define the purpose of the loan, instant loans provide you with the flexibility to use cash, as and when required. You can use the money any way you think appropriate, as mentioned above in this write-up.

- Fast Access to Finances

Instant business loans offer firms quick access to cash via streamlined applications and swift approvals, making them an excellent alternative to deal with unexpected needs or seize time-sensitive opportunities. Enterprises experiencing sudden financial demands or seeking to capitalize on favorable market circumstances may find considerable utility in these loans, as they stand out for their ability to quickly provide cash within hours or days.

Businesses that can adapt swiftly to unanticipated difficulties or new opportunities can rule out interruptions in operations and acquire a competitive advantage. Whether for unforeseen needs, inventory restocking, or investing in a time-bound marketing campaign, the speed and efficiency of instant business loans guarantee that businesses can sail through critical times.

- Simple Application Process

The simple application procedure distinguishes instant business loan online from typical bank loans. Lenders usually approve online applications with minimum paperwork requirements, allowing you to get money with ease and speed. By removing the need for extensive documentation, you may apply quickly and get the financing you want without facing unnecessary delays. With this simplified method, taking instant loans online is an appealing option for businesses looking for a hassle-free, time-saving funding option.

- Increase in Cash Flow

Instant business loans may increase the cash flow by infusing much-needed funds into a business, allowing it to acquire merchandise and equipment or engage in marketing initiatives to boost growth and development. These loans are critical in improving a company’s financial liquidity, ensuring smooth operations, and capitalizing on development prospects.

- No Need for Collateral

Lenders do not require collateral to sanction instant business loans, which is a significant benefit for businesses that do not have valuable assets to pledge. As they are unsecured business loan, these loans reduce the danger of losing assets in the event of a default, allowing businesses to get much-needed financial assistance without the burden of collateral restrictions. Because of this flexibility, taking an instant business loan online is a beneficial choice for entrepreneurs and small firms looking for liquidity without risking assets.

Documents Required for an Instant Business Loan

The documentation needed for an instant business loan may vary based on the lender and the kind of loan requested. However, some typical documents that lenders generally need along with the loan application include:

- Personal KYC: PAN Card.

- Residential Address Proof (any of the following): Rent agreement, Voter’s ID, Driver’s Licence, Ration Card, Passport, Aadhaar Card.

- Banking: Last six months’ current account bank statement.

- Business KYC (any of the following): GST registration certificate, Shops and Establishment Certificate.

- Financial Documents (Needed only for loans over Rs 20 lakhs): Income Tax Return and audited financials of the previous two years, GST returns of six months.

Share it with your loved once WhatsApp.

Considerations Before Applying for an Instant Business Loan Online

Before you go for an instant business loan online, it is critical for you to carefully analyze several aspects to ensure that the loan is suitable for your business requirements and financial capacity. Here are some crucial points to keep in mind:

- Loan Purpose

Clearly state the loan’s purpose. Knowing the exact purpose for the money required can help you pick the correct loan package, whether for paying rent, taxes, acquiring goods, growing operations, or investing in new equipment.

- Payback Conditions

Compare the payback conditions provided by various lenders. Look for choices adaptable to your business’s cash flow and revenue-generating cycles. Avoid loans with strict payback schedules that may burden your budget.

- Interest Rates

Before applying for an instant business loan online, compare interest rates from different lenders. Hidden fees that dramatically increase the final cost of the loan may accompany a relatively modest interest rate. Choose a lender with clear cost structures and competitive interest rates.

- Eligibility Criteria

You must look into the eligibility criteria of different lenders. Each lender may have different parameters in terms of business age, yearly turnover, credit score, and profitability. Before applying, ensure your business fits these requirements to prevent rejection and adverse effects on your credit score.

- Loan Processing Time

Although instant business loans are well-known for their speedy processing, the processing time may differ amongst lenders. Do your research and choose a lender with a reputation for offering business loans with instant approval and disbursement.

- Hidden Fees

Examine the loan document for prepayment penalties, hidden fees, and other factors that affect the overall loan cost before taking out an instant business loan. To make an informed choice regarding the loan, carefully read and comprehend the terms and conditions, and ask for clarification if required.

- Loan Terms and Conditions

Before obtaining an instant business loan online, reading and interpreting the loan agreement is critical. Contact the lender immediately if you have questions about the terms and conditions. Knowing the loan conditions helps you guard yourself against any possible consequences.

This degree of comprehension will assist you in efficiently managing the loan and avoiding misgivings or confusion throughout the repayment process. Remember that obtaining clarity on the agreement is a responsible step toward ensuring a smooth borrowing experience and protecting your venture’s financial interests.

- Impact on Credit Score

Understanding how borrowing might affect your business credit score and future borrowing capacity is critical before applying for an instant business loan. Maintaining a good credit history is vital, so be sure your business can handle debt responsibly and make timely payments. A good repayment track record opens the door to greater financing possibilities in the future.

On the other hand, bad debt management may make it harder to get loans and negatively influence your business’s creditworthiness. Being careful of your borrowing practices and fulfilling payback commitments can aid in the development of a solid financial foundation for your business and promote a good equation with lenders.

Steps to Apply for an Instant Business Loan

You can follow these helpful tips to streamline the process and sеcurе the funding you nееd:

1. Comparе Diffеrеnt Lеndеrs

Start by comparing various onlinе lеndеrs offеring instant businеss loans. Evaluatе factors such as loan amount, interest rate, tеnurе, EMI, procеssing fее, еligibility criteria, documentation requirements, approval and disbursal timе. To makе this еasiеr, usе onlinе platforms or aggrеgators that allow you to compare different loan offers and sеlеct thе оnе that best suits your needs.

2. Chеck Eligibility and Documеnts

Bеforе applying for an instant businеss loan, еnsurе you mееt thе lеndеr’s еligibility criteria. Thеsе criteria typically include factors such as agе, incomе, turnovеr, profitability, crеdit scorе, and industry typе. Additionally, gathеr thе nеcеssary documents rеquirеd by thе lеndеr, such as identity proof, addrеss proof, incomе proof, bank statеmеnts, and GST rеturns.

3. Fill Out the Application Form

Once you have selected a suitable lеndеr and gathered all the required documents, procееd to fill out thе onlinе application form on thеir wеbsitе or mobilе app. Makе surе to providе accuratе and complеtе pеrsonal and businеss dеtails. Additionally, upload thе nеcеssary documents for vеrification and submit thе application form.

4. Gеt Approval and Disbursal

After submitting your application for an instant business loan, await the lender’s response. Thanks to thе strеamlinеd procеss, you can еxpеct a quick approval or rеjеction of your loan application. If approved, accept the loan offer and sign the loan agreement. To facilitatе rеpaymеnt, provide a post-dated cheque or sеt up an еlеctronic mandatе. The lеndеr will then disburse the loan amount to your bank account within onе to thrее businеss days.

Contact Us to Get loan

Share it with your loved once WhatsApp.

Also Read: Pros and Cons of Young Age Jobs

Life Insurance

Life insurance can provide peace-of-mind that your beneficiaries will be provided for after you die. Learn more about selecting the right policy for you, and how some policies can even serve as retirement savings.

If you want to buy life insurance, you need to apply and qualify first. Applying for life insurance typically involves filling out paperwork, taking a medical exam, and providing health histories for you and your immediate family. The lower the risk you present to the insurer, the lower you can expect your premiums to be.

Understanding the process of obtaining life insurance can help you get the coverage you need at a price you can afford. Read on to learn about what’s involved in buying life insurance from the application process through underwriting and reaching a final decision.

KEY TAKEAWAYS

- When applying for life insurance, the insurance company first evaluates your risk of death and assigns a cost to the policy accordingly.

- Most life insurance policies require that you answer medical questions and submit to a medical exam.

- The younger and healthier you are, the lower the premiums will be.

- “No-exam” policies exist, but they usually cost more and have a lower face value.

- It’s important that you tell the truth during the application process, or your beneficiaries may be denied the death benefit.

Determining Your Life Insurance Coverage Needs

There are two main categories of life insurance: permanent life insurance, which provides coverage for your entire life, and term life insurance, which only covers a set period of time. A local insurance agent can help you better understand your options.

Once you have decided to purchase life insurance, you’ll need to determine your coverage amount. Consider how much your beneficiaries will need after you die, how much you already have available through personal assets or group term insurance (such as a policy offered by your employer), and what level of premiums you can afford.

Medical Questions on the Life Insurance Application

Your first step is applying for life insurance coverage with a broker, agent, or directly with an insurance company. The application will ask for basic information such as your name, address, occupation, and employer. It will also typically ask for the following personal information:

- Height

- Weight

- Date of birth

- Lifestyle habits (i.e., smoking, drinking, exercise)

- Health histories of immediate family members

- Current medications

- Financial information, including your annual income and net worth

- Risky hobbies, such as rock climbing or skydiving

- Criminal convictions, particularly moving violations while operating a vehicle

While it may be tempting to lie about your weight or other health issues, it’s important to tell the truth. If the company discovers you lied about a health condition or lifestyle, it may deny your application. If the falsehood is uncovered after the policy is issued, the company can increase your insurance premium, cancel your policy, or deny a beneficiary’s claim to the death benefit.

Some insurance companies only require you to answer health-related questions (such as which medications you take or surgeries you’ve had) on the application. These no-exam life insurance policies—such as guaranteed issue life insurance and simplified issue life insurance—are usually more expensive and offer lower face values than policies that require a medical exam.

The Life Insurance Medical Exam

Most companies and policies require an in-person medical exam. A life insurance agent will arrange for a paramedical (a licensed healthcare professional contracted by the insurance company) to meet you at your home, office, or a clinic selected by the insurance company.

During the exam, the paramedical will likely:

- Record your medical history (including medical conditions, surgeries, and any prescription medications)

- Ask about your immediate family’s medical history

- Take your blood pressure

- Listen to your heartbeat

- Check your height and weight

- Draw a blood sample

- Get a urine sample

- Ask about lifestyle habits that could affect your health (e.g. exercise, smoking, drinking, recreational drug use, frequent travel, high-risk hobbies)

There may be additional tests you need to undergo depending on your age, the type of policy you want, and the amount of coverage you’re applying for. Additional tests could include an EKG, a chest X-ray, or a treadmill test.

Next, an underwriter at the insurance company will review your application and medical exam results. They may order medical records from your physician to learn more about any medical conditions you have and any treatment received. This information helps them determine the level of risk you represent to the company financially and how much to charge you for coverage.

Once your application and medical exam have been reviewed, the company will either approve or deny your request to purchase coverage. That process can take days or weeks, depending on whether you submitted a complete application, how long it takes to receive lab results, whether the company requests information from your physician, and so on.

Share it with your loved once WhatsApp.

Ways to Reduce Your Life Insurance Premium

While you can’t do anything about some of the main factors affecting your insurance premium (age, gender, and family medical history), there are steps you can take regarding lifestyle characteristics. You could lower your insurance premium if you:

- Quit smoking. As a non-smoker, you are likely to live longer. That gives the life insurance company potentially more years to collect your premium payments and less time until they pay out the policy when you die, so that could lower your rate.

- Lose weight. Weight loss often leads to lower cholesterol levels, lower blood pressure, and a lower risk of developing chronic diseases like diabetes. These improvements to your health make you a better insurance risk.

- Reduce or eliminate your alcohol intake. Drinking can pose a potential health risk. Life insurance companies will check your application, driving record, and medical exam to get a picture of your drinking habits. Drinking less alcohol, or stopping entirely, makes you less of a risk for the company; therefore, you’ll likely be rewarded with a lower premium.

- Improve your driving. Insurance companies can hike your premium if you incur multiple moving violations.

Other non-lifestyle-related ways to reduce your premium include:

- Using term instead of permanent life insurance. Depending on your age and how long you expect to need life insurance coverage, you may want to consider using a temporary term policy instead of permanent life insurance. While term policies eventually expire, they cost much less.

- Switching insurers. If you think your current policy is overpriced, you may be able to get similar or better coverage for less money from a different company. Don’t cancel your existing policy though until you’re sure you’ve qualified for the new one.

- Eliminating riders. Riders are optional policy provisions that provide extra benefits for you or your beneficiaries. However, these extra benefits increase your insurance premium. Consider whether there are any riders you could do without. Types of riders include:

- Accidental death benefit rider: pays your beneficiaries if your death was the result of an accident

- Spouse and children’s term life insurance riders: pays if a spouse or child covered under your life insurance policy dies

- Waiver of premium rider: pays your policy premium if you become permanently and totally disabled

- Guaranteed insurability: provides an option to buy additional coverage in the future without having to submit evidence of insurability (such as a new medical exam)

- Accelerated benefits rider: pays a portion of your death benefit payment in advance or your premium if you are diagnosed with a terminal illness, or if you require long-term care or nursing home services.

- Payor rider: waives premiums if you die or become disabled before a covered dependent child reaches a certain age.

- Looking for “no-load” or “low-load” policies. These policies are often less expensive because they don’t pay insurance agents a sales commission or the commission is low.

- Asking about payment discounts. You should receive a discount for paying your bill in full annually rather than paying monthly or quarterly.7 You could also receive a “bundle” discount if you buy your life insurance from the same company as your auto and homeowners insurance.

- Reviewing your credit report for accuracy. Insurance companies can review your credit report when determining your premium. Paying your bills on time, which is noted on your report, assures the company you are likely to pay your premium on time and in full. While your credit report does not determine eligibility, underwriters do look here for factors that affect premium rates, such as bankruptcy and DUI convictions.

- Choosing a company that has experience covering people with your condition. If you have a medical condition, a broker can help find a company that is likely to work with you and may provide a better rate.

- Reviewing your Medical Information Bureau file. Insurers share information on applicants’ medical conditions through the Medical Information Bureau (MIB). Request a free copy of your file from the MIB website and review it; incorrect information could negatively affect your premium.

Share it with your loved once WhatsApp.

Health Insurance

Health Insurance is a type of insurance that covers the medical expenses of the insured due to an illness or accident in exchange for a premium amount. It enables the insurance company to provide medical coverage for hospitalization expenses, day care procedures, critical illnesses, etc. A health plan also offers multiple benefits, including cashless hospitalization and free medical check-ups.

Health Insurance is a contract between the policyholder and the insurer where the health insurance company provides financial coverage to the insured up to the sum insured limit. It offers medical coverage for healthcare expenses incurred during an emergency or planned hospitalization. It also provides tax savings on the premium paid to the insurance company under Section 80D of the Income Tax, 1961.

Benefits of Buying Health Insurance Plans Online

Buying a health insurance policy online comes with several benefits. Take a look at them below:

- Easier to Compare Plans – It is easier to compare health insurance plans from different insurers online at websites like Policybazaar.com to make an informed decision.

- More Convenient – It is more convenient to buy the policy online as you do not have to visit the branch of the insurance company or take an appointment to meet an insurance agent.

- Online Discounts – It allows you to avail discount on premiums for buying the policy online.

- Lower Premiums – Health plans are available for a lower premium online as insurance companies save a lot on operational costs.

- Minimal Paperwork – The process of buying a health insurance policy online involves minimum to zero paperwork.

- Policy Available 24×7 – A health insurance policy can be purchased online any time of the day, even on public holidays, which is not possible in offline buying.

- Digital Payment Options – It allows you to avoid cash payments and use digital payment methods to pay the premium online safely.

- Time-saving – It saves you a lot of time as the policy is issued within a few minutes of buying.

Top Reasons to Buy a Health Insurance Plan

Medical inflation is on the rise making treatments expensive. If you get hospitalized for a critical illness or lifestyle disease, you may end up losing all your savings. The only way to afford quality medical treatment during a health emergency is by buying a health insurance policy. Take a look at some of the top reasons to buy a health insurance plan below:

- Beat Medical Inflation – A health insurance policy can help you pay your medical bills, including pre and post-hospitalization expenses, today as well as in future despite the rising medical costs.

- Afford Quality Medical Treatment – It helps you to afford the best quality medical treatment and care so that you can focus only on getting cured.

- Fight Lifestyle Diseases – It allows you to pay for the long-term treatment of lifestyle diseases like cancer, heart ailments, etc., that have been on the rise with the changing lifestyles.

- Protect Your Savings – It helps you to protect your hard-earned savings by covering your medical expenses so that you can avail the required treatment without any financial worries.

- Avail Cashless Hospitalization Facility – It allows you to obtain a cashless hospitalization facility at any of the network hospitals of your insurance provider by raising a cashless claim.

- Get Tax Benefits – It enables you to save tax on the health insurance premium that you’ve paid under section 80D of the Income Tax Act for better financial planning.

- Ensure Peace of Mind – It allows you to obtain medical treatment with peace of mind as you do not have to worry about paying hefty hospital bills.

What is the Ideal Coverage for Health Insurance?

A general rule of thumb says people should buy health insurance plans with a sum insured of at least half of their annual income. Considering medical inflation, experts suggest buying a medical insurance policy of at least ₹10 lakh. But it’s not that simple.

Health insurance coverage should be tailored to the medical needs and circumstances of the people. Broadly, the ideal coverage amount for medical insurance depends on three factors:

- City of residence (i.e. tier-1, tier-2 or tier-3 cities)

- Age or life stage of the insured

- Cost of hospitalization expenses in future (while considering medical inflation)

A low sum insured of ₹5 lakh may be sufficient for a young person living in a tier-3 city with no pre-existing disease. However, an older person with pre-existing diseases or someone living in a tier-1 will have to opt for a higher sum insured of at least ₹10-20 lakh to cover their medical expenses adequately.

To know your ideal medical insurance coverage amount, check out the table given below:

| Types of Plans | Ideal Health Insurance Sum Insured | ||

| Tier-1 City | Tier-2 City | Tier-3 City | |

| Individual Health Insurance Plan | ₹10 lakh & above | ₹5-10 lakh | ₹5 lakh |

| Family Floater Health Insurance Plan | ₹30 lakh & above | ₹20 lakh & above | ₹10 lakh & above |

| Senior Citizen Health Insurance Plan | ₹20 lakh & above | ₹15 lakh & above | ₹10 lakh & above |

*Disclaimer: The above sum insured is suggestive and may vary as per the age and medical needs of the people.

Alternatively, people can also opt for a ₹1 crore health insurance policy that has become extremely affordable these days. A ₹1 crore health policy can come in handy for the treatment of a critical illness that goes on for a long duration or for treatments taken abroad. You can easily get a ₹1 crore health cover by paying approximately Rs 1500 more premium.

Additionally, people can also opt for a base health insurance policy with a low sum insured and buy a top-up cover with a high sum insured, which is a more affordable option.

Share it with your loved once WhatsApp.

Key Benefits of Health Insurance Plans in India

Health insurance plans offer a variety of health benefits to the insured, depending on the plan. Following are the key benefits of buying a health insurance plan in India:

- Hospitalization Expenses – A health insurance plan covers the medical expenses incurred on getting admitted to a hospital for more than 24 hours. It includes room rent, doctor’s fee, medicine costs, diagnostic test fees, etc.

- Pre & Post Hospitalization Expenses – It covers the medical expenses that you may have incurred on an illness before getting hospitalized as well as follow-up treatment expenses incurred after getting discharged. The pre-hospitalization and post-hospitalization expenses are covered up to a fixed number of days as specified in the policy document.

- ICU Charges– A health insurance plan also covers the cost of availing treatment in an ICU or Intensive Care Unit during hospitalization.

- Ambulance Cost – It covers the cost of ambulance services availed to reach the nearest hospital during a medical emergency.

- Cashless Treatments – All health insurance providers in India offer cashless treatment facilities at their network hospitals. You do not have to worry about arranging money to pay the hospital bills if you get admitted to a network hospital, as it will be settled by your insurer under cashless claims.

- Day Care Procedures – It also covers the cost of availing day care treatments that require hospitalization of less than 24 hours.

- Pre-existing Diseases– The best health insurance policy also provides coverage for pre-existing diseases after you have completed the waiting period. Usually, pre-existing diseases are covered after a waiting period of 2 to 4 years.

- AYUSH Treatment – It covers the cost of availing medical treatment through the AYUSH system of medicines that includes Ayurveda, Unani, Homeopathy, Siddha and Yoga.

- Medical Check-ups – Most health insurance companies in India offer free preventive health check-up facilities to the insured at regular intervals depending on the policy terms and conditions.

Contact Us to Get Perfect Health Insurance For You

Motor Insurance

Motor insurance explained

You have to have motor insurance before you can drive your vehicle in a public place. It protects you, your vehicle and other motorists against liability in case there is an accident. It provides financial compensation to cover any injuries caused to people or their property.

Motor Insurance is a contract you and your insurer enter into, to protect you from financial damages caused by unforeseeable circumstances like accidents, theft, and even natural calamities. The Government of India has made it mandatory for all motor owners to have a third-party motor insurance policy. This policy covers the damages caused to life and property of individuals, other than you, affected by an accident your motor unfortunately becomes a part of. The other most common form of insurance is Comprehensive motor Insurance. It helps you cover majority of the liabilities you might attract if your car gets damaged in a social unrest, natural calamity, or even gets stolen in a case of theft.

Comprehensive motor Policy means Package policy, henceforth on the page where ever Comprehensive Motor policy is mentioned it means Package policy.

As a motor owner, it is important for you to have the right motor insurance policy. When searching for motor insurance online, make sure you completely understand the nature and terms & conditions of the policy.

WHY SHOULD YOU BUY A CAR/MOTOR INSURANCE POLICY?

Buying a car is one thing and maintaining it is something that is completely different. The roads are some of the most uncertain places, where negligence, ignorance, carelessness of others or just sheer bad luck can bring about a lot of consequences to you and your car.

And as a car owner, these consequences do cost you a lot. From a small dent on the trunk to major accidents and natural disasters, a car on the road is subjected to diverse threats on a daily basis. Moreover, money is involved in every stage of the car’s recovery and safety. That’s why a car insurance policy becomes inevitable in today’s age.

If you haven’t taken four wheeler insurance for your car yet or if you’ve just bought a new car and are looking for a car insurance policy, here are some extensive reasons you should get one today.

-

Covers Expenses On Own Damage

Apart from accidents, cars can be damaged due to natural disasters, Regardless of the reason, expenses are involved in getting the car repaired. That’s why it’s ideal to buy a car insurance as it covers damages arising due to unforseen accidents.

-

Third-party Liabilities

A car is a machine that is subjected to technical issues. A car gone out of control is a threat to civilians and public properties. If there has been an accident with your car, you are bound to compensate for the damages caused. If you have a car insurance policy, your insurance company will take care of the liabilities

-

Personal Accidents

Having a four wheeler insurance is like driving with a lifeguard. There is a backup you have to cover the expenses incurred due to car accidents. A car insurance policy also compensates for permanent disability arising due to a car accident. This is an ideal financial support that is inevitable for families. The car insurance plan can also have cover for you and occupants for accidental death and permanent total or partial disability (loss of limb) due to accident of car.

-

Mandatory By Law

If you are a car owner, you should mandatorily have a minimum of a third-party car insurance according to the Motor Vehicles Act. Failing to have is an offence and you could be penalized for it when caught.

-

Extended Benefits with Add-ons

Apart from the benefits you just saw, you could include add-on benefits such as depreciation shield cover, consumables expenses, breakdown assistance, conveyance benefits, Engine protector and more when you buy car insurance. This only makes your policy loaded with more benefits.

-

Additional Convenience

An extensive online four wheeler insurance policy also allows you to experience benefits like coverage of, paperless-digital insurance applications and processing, online claims, spot services and more.

Share it with your loved once WhatsApp.

Ground Zero is here to help you navigate the journey of having our own motor insurance with a seamless process.

Also Read: Why You Should Start Working Young

0

Welcome to Ground-Zero Family